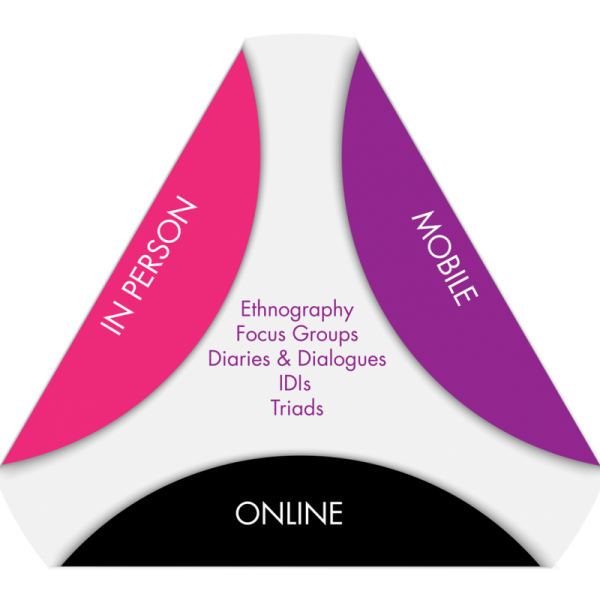

HOW WE DO IT

Customized qualitative market research strategies to fit the needs of your brand.

Mixing methodologies, or even creating new ones, is what we love to do, because every client is different, and every research project is unique. We work with our clients to find the best methodologies to answer the research need.

Focus Groups

Focus groups are the gold standard in qualitative research and a foundational research method that started it all! Focus groups are still a relevant and often-used method in qualitative market research studies, especially when group interaction is desired. Thanks to advances in technology, focus groups can now be conducted in-person or online. H.I. Thomas Group has moderated focus groups in people’s homes (such as hosting a “party” to understand wine consumption), at focus group facilities (to taste a new brand of ham), online (engineers from all over the world, reacting to a new concept), and even in a parking lot (to discuss new truck accessories with long-haul truckers). The key to success is a well-briefed focus group moderator with lots of experience to guide the conversation.

IDIs (In-Depth Interviews) / Dyads / Triads

In-depth interviews are one of our favorite market research study methods, especially when trying to understand complex thoughts and processes, such as a consumer’s purchase journey. In-depth interviews can be conducted in-person, online or even on a mobile device.

Ethnography

Of all the methods in our toolkit, ethnographic research is not only one of our favorites, but also the one we’ve been doing the longest. Ethnographic market research often combines a pre-interview by phone as a warm-up, followed by a home/office visit and then concludes with a shop-along. The shop-along portion can be either at a brick and mortar store or sitting shoulder-to-shoulder in front of a laptop. The insights and relevance associated with ethnographic studies are far-reaching and powerful.

Diaries and Dialogues

Diaries and dialogues are an important element to many surveys which help to reveal deeper insights over a long period of time. For example, dieters can answer brief questions once a week about their satisfaction and progress with a diet plan, and help us to build a better foundation of understanding. Complementary diaries add an emotional dimension to survey data that can offer additional insights.

Shopper Observation

Our team visits brick-and-mortar stores to observe hundreds of shoppers from a comfortable distance without disturbing or influencing their path to purchase. Either as one observer or as a team, we tally what shoppers look at, touch and put in their shopping cart. We measure how long shoppers spend in front of our client’s products and observe non-verbal behavior. In the end, we can calculate what percentage of shoppers purchased from our client’s product mix as well as many other variables.

Shop-Alongs

Shop-alongs are another gold standard in the qualitative market research toolkit. Shop-alongs are where we either observe shoppers from a distance or stand shoulder-to-shoulder as they “think out loud” for us. This may seem like a common process, but our years of experience in qualitative market research and marketing across many industries allows us to quickly spot frustrations and recommend fixes in packaging, merchandising, and product.

Store Intercept Surveys

Our team administers short shopper surveys on an iPad as they are exiting the store. These surveys help us collect quantitative data that is useful for uncovering customer insights. Often, this method is combined with Shop-Alongs and In-Store Observations for a more complete view of the retail experience.

Convention-Based Research

Conferences, conventions, and trade shows offer a captive audience for research studies. We frequently conduct research at such events for various reasons including showing new product concepts, conducting focus groups with critical influencers, or administering iPad surveys to convention attendees. Take advantage of having your customers gathered in one place at one time!

Laddering – “Why They Buy”

Laddering is a structured process of asking questions that eventually reveal a deep understanding of purchase motivations that often cannot be otherwise uncovered from other types of qualitative market research surveys. Early in Helen’s career, she was lucky enough to have been trained in the Laddering technique by one of its creators, Dr. Jonathan Gutman. This process involves a revealing matrix of product/service attributes, consequences and values which can be used in developing communication strategies that speak to consumers on a very personal and emotional level. This method pushes us to go beyond what customers are buying and how, to why.

IHUT (In-Home Use Test)

Installing new products in consumers’ homes for a certain length of time is the ultimate real-world method for product research. Whether it is an appliance, plumbing fixture, hair product, or frozen dinner, our digital tools allow users to check in on a regular basis, take short videos and answer questions in the privacy of their homes using a smartphone.